Difference between revisions of "Test2"

Jump to navigation

Jump to search

| (35 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

= | == Reporting services using www.e-file.lu == | ||

<inputbox> | |||

type=create | |||

break=no | |||

</inputbox> | |||

< | <imagemap> | ||

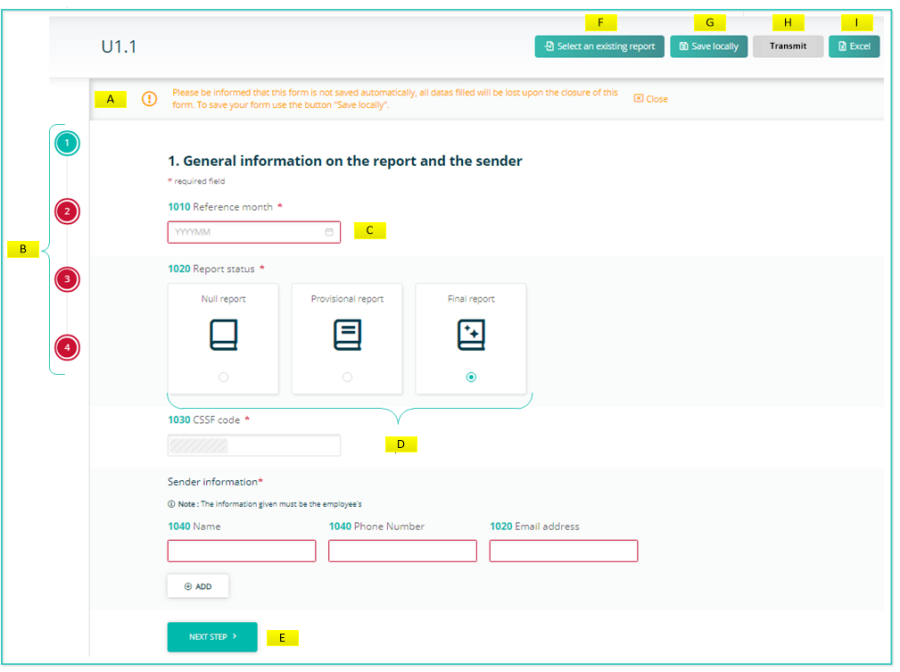

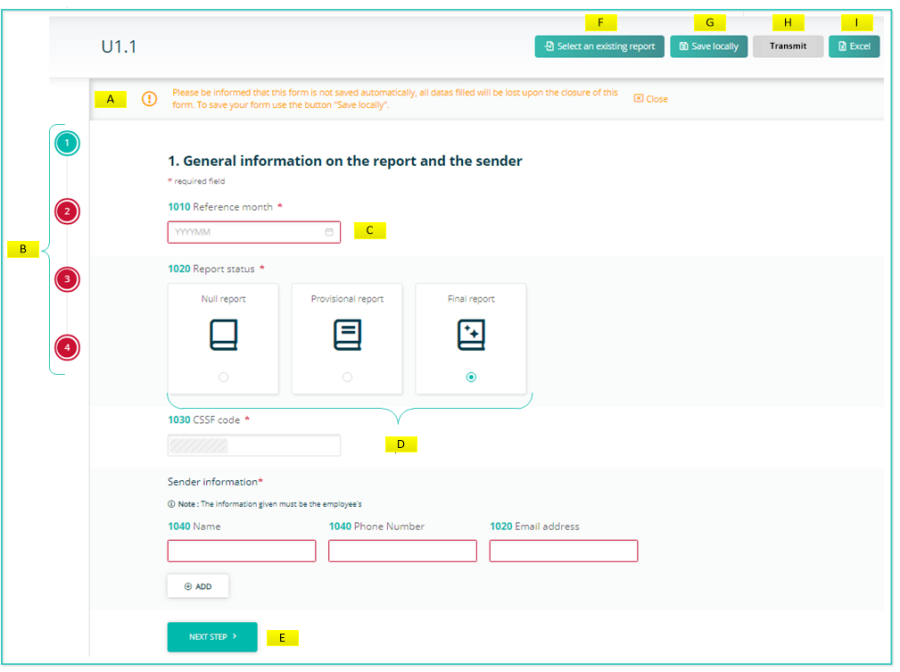

File:Final_U11Form.png|center|900px|alt=clickable image : form description| titre | |||

This | rect 771 131 106 90 [[#See|warning: no auto saving]] | ||

rect 7 138 92 427 [[#See|Vertical navigation bar pages open vertically. Buttons remain red if data are missing or wrong.]] | |||

rect 189 226 432 274 [[#See|Calendar to pick the reference date.]] | |||

poly 186 313 597 314 601 455 472 463 470 507 429 507 423 466 184 457 [[#See|Icons to select Report status.]] | |||

rect 182 690 332 734 [[#See|Click on NEXT STEP or PREVIOUS STEP to switch to the next or previous page, or click on one of the sidebar navigation buttons.]] | |||

rect 598 13 744 62 [[#See|Select an existing report button: This button allows you to upload an existing XML report from your network or hard-drive into the report generator.]] | |||

rect 753 18 839 66 [[#See|Save locally button: Work in progress on a report has to be saved with this button. Work in progress means that the report is not completed, because important data are missing. The exported .xml file will be called ''DRAFT_filename.xml'' and cannot be uploaded for filing. It can be imported onto the tool for later use. If you save locally a final report, meaning that all relevant data are available inside the report, it will carry the correct naming convention for submission to the Regulator.]] | |||

rect 925 65 844 17 [[#See|Transmit button: If the four buttons of the sidebar are green, the Transmission button will become available and the report can be transmitted to the regulator]] | |||

rect 932 19 985 62 [[#See|EXCEL button: Press this button to export an uncompleted or finalized report in EXCEL format. This file serves for your internal purpose only, however it cannot be imported.]] | |||

desc none | |||

</imagemap> | |||

{|border="1" cellspacing="2" cellpadding="10" style="text-align:left; width=80%;" | |||

|- | |||

| | |||

! scope="col" | Prerequisites | |||

|- | |||

! scope="row" | Proxy, antivirus | |||

| The ports '''80''' (HTTP) and '''443''' (HTTPS) must be enabled<br>as well as those technical URLs : '''www.e-file.lu/WSEfileFlex''' and '''www.e-file.lu/WSEfile''' | |||

|- | |||

! scope="row" | Cookies | |||

|Cookies have to be '''enabled''' <br> [https://www.whatismybrowser.com/guides/how-to-enable-cookies/ How to enable Cookies] | |||

|- | |||

! scope="row" | Web browsers | |||

| e-file is compliant with most current browsers, in their default setup : [[File:Icon Chrome.png | 30px]] [[File:Edge Chromium.jpg | 45px]] [[File:logo_ff.jpg | 35px]] [[File:logo_safari.jpg | 40px]]<br>Please call us if you have a particular configuration. | |||

|} | |||

< | |||

''' | |||

[[File: | |||

[[File: | |||

Latest revision as of 11:43, 19 June 2023

Reporting services using www.e-file.lu

| Prerequisites | |

|---|---|

| Proxy, antivirus | The ports 80 (HTTP) and 443 (HTTPS) must be enabled as well as those technical URLs : www.e-file.lu/WSEfileFlex and www.e-file.lu/WSEfile |

| Cookies | Cookies have to be enabled How to enable Cookies |

| Web browsers | e-file is compliant with most current browsers, in their default setup : Please call us if you have a particular configuration. |