Difference between revisions of "CRS Manual"

| Line 48: | Line 48: | ||

==Complete CRS form== | ==Complete CRS form== | ||

===Contact tab=== | |||

====AEOI reference==== | ====AEOI reference==== | ||

[[File:]] | [[File:CRS AEOI REF.jpg]] | ||

*This field has to be completed with a unique identifier. | *This field has to be completed with a unique identifier. | ||

| Line 66: | Line 68: | ||

====Information on depositor==== | ====Information on depositor==== | ||

[[File:]] | [[File:CRS Dep matricule.jpg]] | ||

*'''Depositor name''' (pre-filled): The '''Depositor''' is an entity (legal or natural person) that is in charge of filing the | *'''Depositor name''' (pre-filled): The '''Depositor''' is an entity (legal or natural person) that is in charge of filing the CRS reporting to the ACD (e.g. Service provider). The depositor and the declarer may be the same entity. Cf. [http://www.impotsdirects.public.lu/content/dam/acd/fr/legislation/legi17/ECHA4.pdf, ECHA - n° 4 of 6 February 2017, page 10]. | ||

*'''Personal Identification Number''' (pre-filled): The '''Depositor''' needs a '''Personal Identification Number''' (Luxembourgish '''Matricule''' Number also known as CCSS code) to be able to file the report. | |||

If the '''Depositor''' does not have a Luxembourgish '''Matricule''' Number, he has to contact the '''Bureau de la retenue d'impôt sur les intérêts''' to obtain one (Form 914F). | If the '''Depositor''' does not have a Luxembourgish '''Matricule''' Number, he has to contact the '''Bureau de la retenue d'impôt sur les intérêts''' to obtain one (Form 914F). | ||

Revision as of 14:50, 16 April 2017

Introduction

The Luxembourg Tax Authority (Administration des contributions directes (ACD)) published on 6 February 2017 the ECHA - n° 4 Circular. This Circular describes the format and procedures of the Common Reporting Standard (CRS) that Luxembourg Reporting Financial Institutions (RFI) will have to follow according to the CRS Luxembourg law, 24 December 2015.

Manual filing through e-file v2

Environment

Step 1: Select your environment:

Production environment : https://www.e-file.lu/e-file/

Homologation environment (Test) : https://homologation.e-file.lu/e-file/

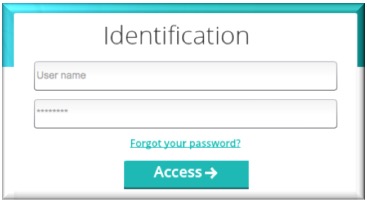

Login

Step 1: Enter your e-file login credentials (user name and password) and click the Access button.

IMPORTANT: If you do not have an e-file user account or if you do not remember your password, you might contact your e-file administrator of your company.

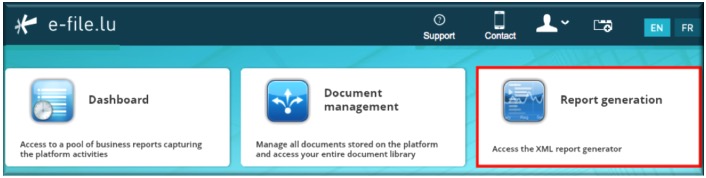

Access CRS form

Step 1: Click on the Report Generation icon:

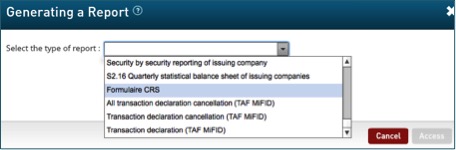

Step 2: Select Formulaire CRS

Result: the CRS form opens

Complete CRS form

Contact tab

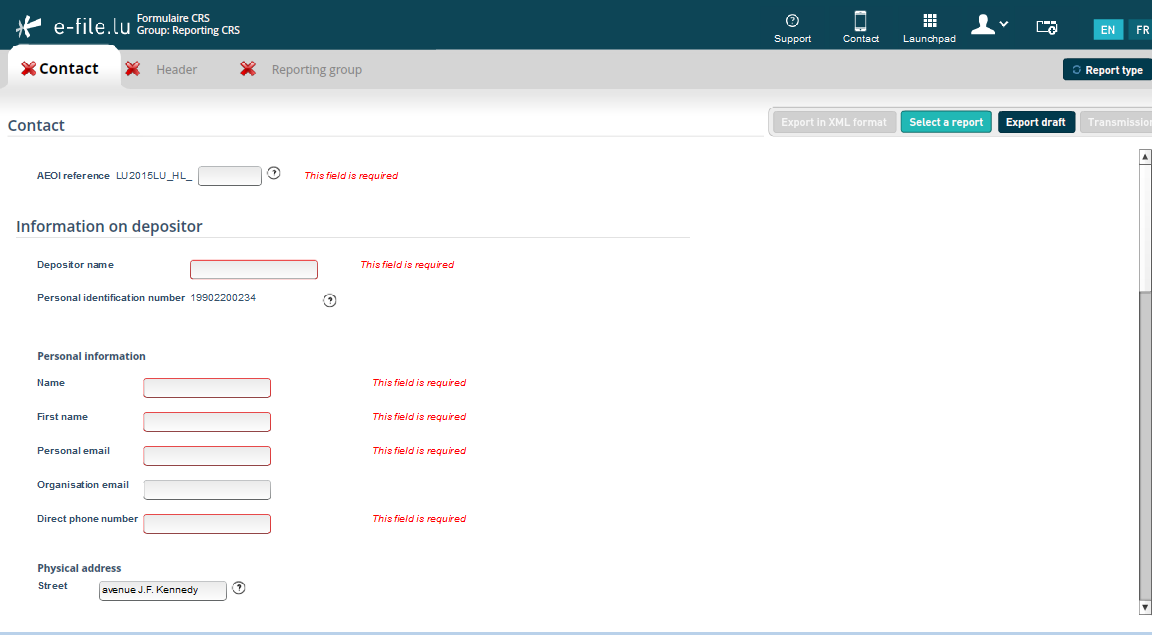

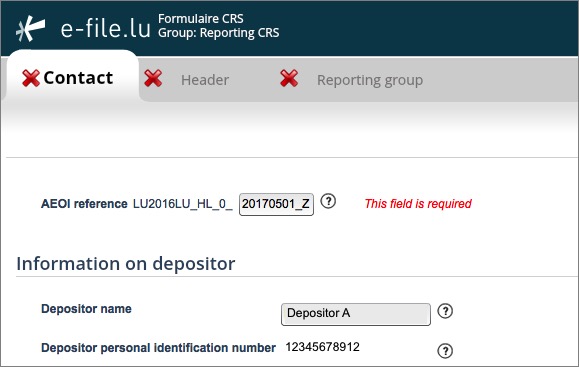

AEOI reference

- This field has to be completed with a unique identifier.

- The ACD recommends to use a "timestamp", a digital counter or a "GUID" (Globally Unique Identifier).

- Specification examples: only capital characters (A-Z), number 0-9, must be unique, etc.

- The ACD asks not to include confidential data in the identifying elements.

Cf. ECHA - n° 4 of 6 February 2017, page 21-22.

Information on depositor

- Depositor name (pre-filled): The Depositor is an entity (legal or natural person) that is in charge of filing the CRS reporting to the ACD (e.g. Service provider). The depositor and the declarer may be the same entity. Cf. ECHA - n° 4 of 6 February 2017, page 10.

- Personal Identification Number (pre-filled): The Depositor needs a Personal Identification Number (Luxembourgish Matricule Number also known as CCSS code) to be able to file the report.

If the Depositor does not have a Luxembourgish Matricule Number, he has to contact the Bureau de la retenue d'impôt sur les intérêts to obtain one (Form 914F).

-by mail: aeoi@co.etat.lu

-by phone: Phone book_Bureau de la retenue d'impôt sur les intérêts

IMPORTANT: all pre-filled data have to be communicated to Fundsquare in order to be integrated in Fundsquare's database and to be available in the CRS form

Cf. Onboarding/Update process FATCA/CRS

Send mail to: OnboardingFatcaCRS@fundsquare.net

Information on declarer

The declarer may be the Reporting Financial institution (RFI) that is subject to the CRS reporting obligation or an entity, e.g. a management company, preparing the report for the RFI.

The ACD needs contact details of a person who would be able to answer business questions regarding the report.

Cf. ECHA - n° 4 of 6 February 2017, page 10

[[File:]]

Reporting person

The Reporting Person is the Reporting Financial Institution (RFI) that is subject to the CRS Reporting. The ACD needs contact details of a person at the RFI.

[[File:]]

- Name of the reporting financial institution: Select the entity in the drop-down list for which the reporting is done.

- Reporting person: pre-filled once the RFI has been selected

The concatenation of the Identification Number and Identification Number Extension is used to identify the RFI.

The Identification number is the Luxembourg Matricule number and the Identification Number Extension (Default value "M00000000" (M with 8 zeros)).

When a sub-entity wishes to make a declaration and does not have a personnel number, it puts the parent entity's number in the first field and an additional identifier in the second field. For example, fund compartments that want to report directly, can use the umbrella number in the <IdentificationNumber> field and put the compartment number in the <IdentificationNumberExtension> field. Instructions published on the ACD7 website should be followed in the event that the Luxembourg Financial Institution has no registration number.

Zero Reporting

A "ZeroReporting" message is a message stating that the Luxembourg reporting financial institution has no data to report for the relevant tax year.

Unlike FATCA, the ACD has decided that filing a "zero reporting" is not mandatory.

Cf. ECHA - n° 4 of 6 February 2017, page 11

[[File:]]