Difference between revisions of "FATCA Manual"

| Line 128: | Line 128: | ||

'''IMPORTANT''': all '''pre-filled''' data have to be communicated to Fundsquare in order to be integrated in Fundsquare's database and to be available in the FATCA form | '''IMPORTANT''': all '''pre-filled''' data have to be communicated to Fundsquare in order to be integrated in Fundsquare's database and to be available in the FATCA form | ||

Consult our [https://www.e-file.lu/wiki/index.php/FATCA_Onboarding FATCA Onboarding] for more detailed information. | |||

Send mail to: [mailto:OnboardingFatcaCRS@fundsquare.net OnboardingFatcaCRS@fundsquare.net] | Send mail to: [mailto:OnboardingFatcaCRS@fundsquare.net OnboardingFatcaCRS@fundsquare.net] | ||

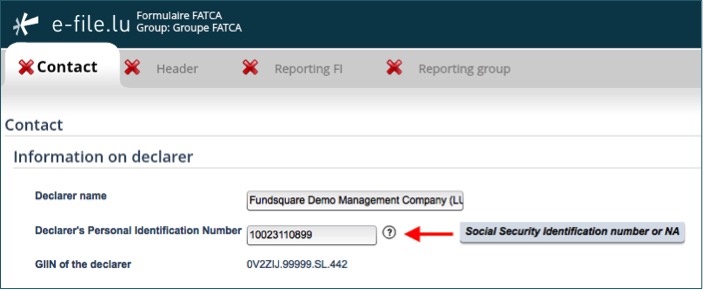

====Information on declarer==== | ====Information on declarer==== | ||

Revision as of 08:25, 22 October 2019

Introduction

The Luxembourg Tax Authority (Administration des contributions directes (ACD)) published on 19 January 2017 an updated version of the circular ECHA3 defining the new format that takes into account the Internal Revenue Services (IRS) FATCA XSD 2.0. Luxembourg Financial Institutions will have to use this new schema, as it will be the only one accepted as from now.

Manual filing through e-file v2

Environment

Step 1: Select your environment

Production environment : https://www.e-file.lu/e-file/

Homologation environment (Test) : https://homologation.e-file.lu/e-file/

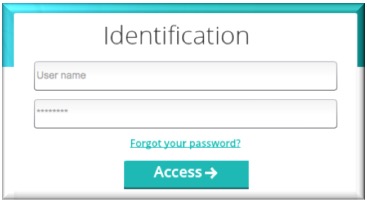

Login

Step 1: Enter your e-file login credentials (user name and password) and click the Access button

IMPORTANT: If you do not have an e-file user account or if you do not remember your password, you might contact your e-file administrator of your company.

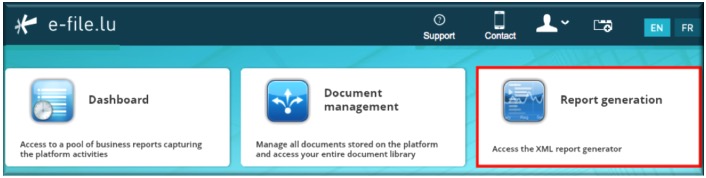

Access FATCA form

Step 1: Click on the Report Generation icon

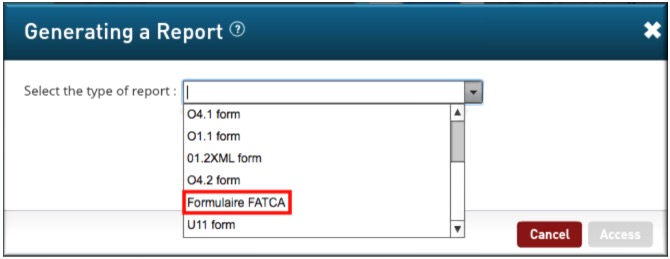

Step 2: Select Formulaire FATCA

Result: the FATCA form opens

Complete FATCA form

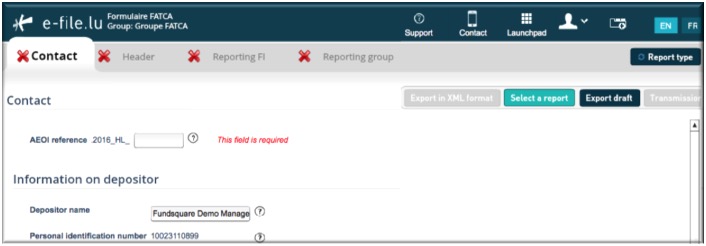

Contact tab

This is the Luxembourgish part of the FATCA report added by ACD.

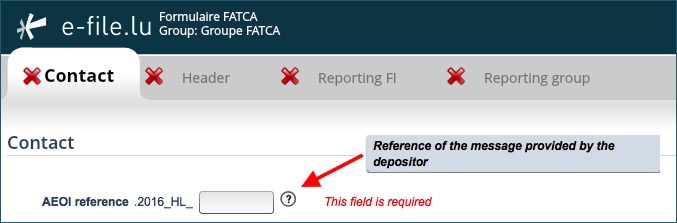

AEOI reference

- This field has to be completed by a Globally Unique Identifier (GUID) that can be choosen freely in accordance with certain rules described in ECHA - n° 3 of 19 January 2017, page 13.

- Specification examples: only capital characters (A-Z), number 0-9, must be unique, etc.

- The ACD recommends not to use personal data such as the name or account number, but rather a sequential number.

Cf. ECHA - n° 3 of 19 January 2017, page 13.

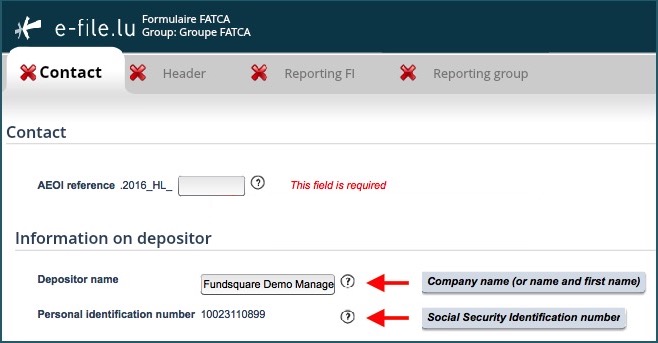

Information on depositor

- Depositor name (pre-filled): The Depositor is an entity (legal or natural person) that is in charge of filing the FATCA reporting to the ACD (e.g. Service provider). Cf. ECHA - n° 3 of 19 January 2017, page 6.

- Personal Identification Number (pre-filled): The Depositor needs a Personal Identification Number (Luxembourgish Matricule Number also known as CCSS code) to be able to file the report.

If the Depositor does not have a Luxembourgish Matricule Number, he has to contact the Bureau de la retenue d'impôt sur les intérêts

-by mail: aeoi@co.etat.lu

-by phone: Phone book_Bureau de la retenue d'impôt sur les intérêts

IMPORTANT: all pre-filled data have to be communicated to Fundsquare in order to be integrated in Fundsquare's database and to be available in the FATCA form

Consult our FATCA Onboarding for more detailed information.

Send mail to: OnboardingFatcaCRS@fundsquare.net

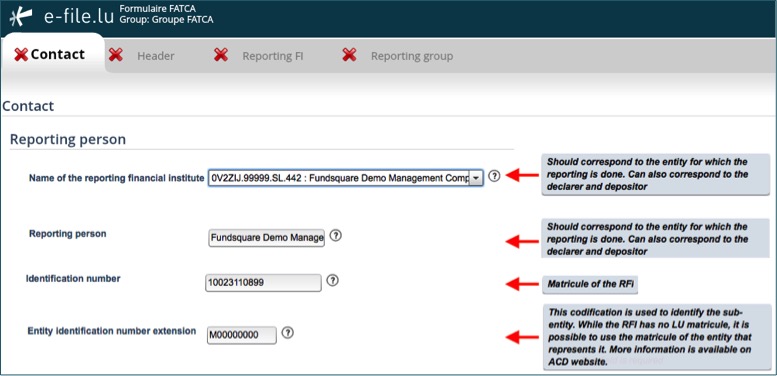

Reporting person

The Reporting Person is the Reporting Financial Institution (RFI). This element is used by the ACD for tracking purposes (i.e. in case of Zero Reporting).

It is the same entity as in the "Reporting FI" tab.

- Name of the reporting financial institution: Select the entity in the drop-down list for which the reporting is done.

- Reporting person (pre-filled once the RFI has been selected)

- Identification number (pre-filled with the Luxembourgish Matricule Number once the RFI has been selected)

- Entity Identification number extension (pre-filled with the value "M00000000"): "M00000000" is the default value if you have no extention code to communicate.

IMPORTANT: If a sub-entity has to file a FATCA reporting and does not have a Luxembourgish Matricule Number, it must enter the parent Luxembourgish Matricule Number in the first field and an additional identifier in the second field. For example, sub-funds have to enter the Luxembourgish Matricule Number of the umbrella fund in the Identification Number field and enter the sub-fund number in the Entity Identification number extension field. Cf. details ECHA - n° 3 of 19 January 2017, page 9.

If the RFI has no Luxembourgish Matricule Number the instructions published on the ACD website have to be followed (Cf.: Contact_Division échange de renseignements et retenue d’impôt sur les intérêts).

IMPORTANT: all pre-filled data have to be communicated to Fundsquare in order to be integrated in Fundsquare's database and to be available in the FATCA form

Consult our FATCA Onboarding for more detailed information.

Send mail to: OnboardingFatcaCRS@fundsquare.net

Information on declarer

The declarer may be the Financial institution that is subject to the FATCA reporting obligation or an entity, e.g. a management company, managing the reporting from a business point of view.

The ACD needs contact details of a person who would be able to answer business questions regarding the report.

Cf. Annexe 1 ECHA - n° 3 of 19 January 2017, page 50).

Zero Reporting

The ACD requires one reporting each year from each Luxembourg Reporting Financial Institution registered with the IRS.

Luxembourg Reporting Financial Institutions that have no Reportable Accounts to report for a year, must inform the ACD by sending a Zero Reporting to the ACD.

Cf. ECHA - n° 3 of 19 January 2017, page 21.

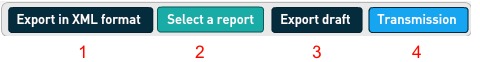

Export - import files - save work in progress

1. Click this button to export the final report in XML format. The file will be saved on your hard drive and is available for sending to the Regulator. This button will only be available if the green tick ![]() appears in every section of the completed form.

appears in every section of the completed form.

2. This button allows you to upload an existing XML report from your network or hard drive into the report generator.

3. Work in progress on a report has to be saved with this button. The exported .xml file will be called DRAFT_filename.xml and cannot be uploaded for filing. It can be imported onto the tool for later use. Only final reports will carry the correct naming convention for submission to the Regulator.

4.If green ticks ![]() appear in every section of the completed form, the Transmission button will become available.

appear in every section of the completed form, the Transmission button will become available.

File transmission

Setup of the e-file v2 Transmission Module

Step 1: The form is completed. Click the

button.

Result: the EfileCrypto.jnlp file is generated.

IMPORTANT: this file has to be downloaded (if you use the application for the first time) locally on your computer and must be opened to launch the Transmission Module.

Note: the Transmission Module is a Java application. For security reasons, this module aims at encrypting documents before they are sent to authorithies. It is also used to decrypt documents and feedbacks.

Java version 1.7.55 is a prerequisite for the installation of the e-file v2 Transmission Module.

Step 2: Click the Open button of the EfileCrypto.jnlp file

Result: the window below opens

Step 3: Click thebutton

Result: the Transmission Module is launched

Important: It is possible that the pop-up blocker does not allow .jnlp files to be downloaded. Please ask your IT deparment to allow pop-ups from https://www.e-file.lu/ .

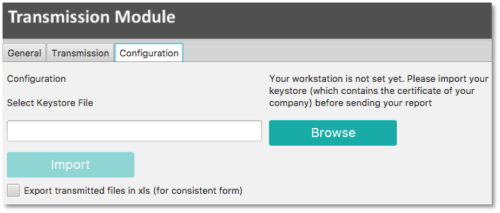

Step 4: The Transmission Module has to be configured when it is used for the first time (or after each Java update).

The path to the keystore has to be selected with the ![]() button and the key (locally or on a server) will have to be imported with the

button and the key (locally or on a server) will have to be imported with the ![]() button :

button :

Once the key has been imported, the access to the keystore is memorized by the application.

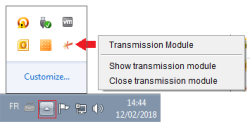

In order to be more user friendly and to speed up the sending process, the Transmission Module will then run as a back ground process on your desktop.

If you need to end the process, right click on the icon in the taskbar and select “Close Transmission Module” :

Step 5: Return to the FATCA Form (Report Generator) screen - Click thebutton - Enter a "title of file sent" - Enter the keystore password

Result: as the configuration of the Transmission Module is finished, the General Tab of the Transmission Module will be displayed directly.

Note:

-the file name is automatically generated and compliant to the ACD file naming convention.

-the ![]() button is now available and the report can be sent. A pop-up window will confirm the transmission.

button is now available and the report can be sent. A pop-up window will confirm the transmission.

SHOULD YOU ENCOUNTER PROBLEMS PLEASE CONSULT OUR WIKIPAGE SOLVING THE MOST COMMON PROBLEMS OF THE TRANSMISSION MODULE OR CONTACT OUR Client Support & Operations Desk.

File transmission follow-up

PLEASE CONSULT OUR WIKIPAGE TRANSMISSION FOLLOW-UP

Automatic filing through the Sending Service

The Sending Service is Fundsquare's solution for automatically sending reports and documents to the authorities.

With a suitable network mapping, users can then simply copy the file to be sent in the appropriate directory.

The file is then automatically encrypted and sent.

FATCA .xml files have to be dropped into the FATCA subfolder:

- Should you need further information on the Sending Service, please click the links below:

Sending Service Installation Procedure

Sending Service Update Procedure

FATCA file naming convention

The following naming convention has to be applied for the files:

XML file :

FATCA_${DateTime}_${Type}_${FiscalYear}_${Channel}_${MatriculeDepositor}_${GIIN}_${ProdTest}.xml

Feedback from ACD :

FATCA_${DateTime}_${Type}_${FiscalYear}_${Channel}_${MatriculeDepositor}_${GIIN}_${ProdTest}_${Status}.xml

| Code | Definition | Structure | Values |

|---|---|---|---|

| DateTime | Creation date and time of the XML file | Number(14) | YYYYMMDDhhmmss |

| Type | F0: ZeroReport or new contact data without FATCA data

F1: FATCA1–New data F2: FATCA2–Correction–Data corrected upon request of the IRS F3: FATCA3–Void–Cancellation of data F4: FATCA4–Amendment–Data corrected at any time |

Char(1)Number(1) | F0

F1 F2 F3 F4 |

| FiscalYear | Fiscal year | Number(4) | YYYY |

| Channel | Communication channel | Char(1) | B = Bourse |

| MatriculeReporter | Social Security Identification Number | Number(11) - Number(13) | Code CCSS |

| GIIN | GIIN (Global Intermediary Identification Number ) of the declarer | Char(6).Char(5).Char(2).Number(3) | Code GIIN XXXXXX.XXXXX.XX.XXX |

| ProdTest | Environment type | Char(1) | P = Production

T = Test |

| Status | Response status | Char(3) | Technical Feedback

ACK = File received by ACD NAK = File rejected by ACD Business Feedback VAL = Validated and imported by ACD WAR = Validated and imported by ACD but with small issues that raised a warning ERR = File rejected |

Examples:

XML file:

FATCA_20150520080022_F0_2016_B_1970010112345_006M8M.00000.LE.442_P.xml

FATCA_20150520080023_F1_2016_B_19700202123_ZZLRV4.99999.SL.442_T.xml

Feedback from ACD :

FATCA_20150520080022_F0_2016_B_1970010112345_006M8M.00000.LE.442_P_ack.xml

FATCA_20150520080023_F1_2016_B_19700202123_ZZLRV4.99999.SL.442_T_ack.xml

Cf. ECHA - n° 3 of 19 January 2017; page 19-20

Report transmission

In order to send a report with the Sending Service, the exported .xml report has to be copied into the …/ServiceDeposant/ReportingDiffusion/FATCA subfolder.

Ensure that the FATCA file naming convention is applied (Cf. FATCA file naming convention).

File processing status generated by the Sending Service

During and at the end of the sending, the Sending Service generates various files in the subfolder that

has been used for the sending. Three type of files are generated:

- .trt file : indicates the start of the transmission

In order to be able to send the original file, the Sending Service transforms the latter into a .trt file and adds a timestamp. E.g. «OriginalName.xml» is transformed into OriginalName.xml.timestamp.trt:

FATCA_20150520080022_F0_2016_B_1970010112345_006M8M.00000.LE.442_P.xml becomes

FATCA_20150520080022_F0_2016_B_1970010112345_006M8M.00000.LE.442_P.xml_20150731122616366.trt

- .acq file : the transmission has been successfully completed

- .err file : indicates that an error has occurred during the sending

The error file contains technical messages indicating the root cause of the error, e.g. file name errors.

File transmission follow-up

Transmission status

ACD's feedback files are available in the sub-folder "Replies": .../ServiceDeposant/ReportingDiffusion/FATCA/Replies/.

Each feedback has a specific status which is available in the file name: ACK, NAK, VAL, WAR, ERR (Cf. Status feedback ACD).

Feedback from ACD :

FATCA_20150520080022_F0_2016_B_1970010112345_006M8M.00000.LE.442_P_ack.xml

FATCA_20150520080023_F1_2016_B_19700202123_ZZLRV4.99999.SL.442_T_ack.xml

The "Replies" folder is created upon feedback receipt. Please check the Sending Service's configuration if the "Replies" folder is not available. In the configuration file (properties file), the variable corresponding to "Configuration of connection for feedback" and the one corresponding to "Configuration of connection for authority acknowledgement" should be set to "up".

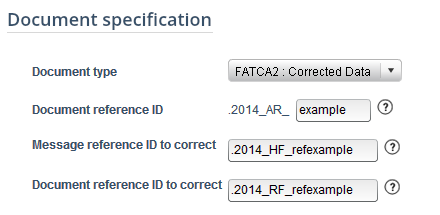

How to correct, void or amend validated reports

In order to correct, void or amend reports through the FATCA Form (Report Generator), the type of modification (FATCA2, FATCA3, FATCA4) has to be selected in the "Reporting FI" tab, section "Document Specification" and in the "Reporting Group" tab, section "Account Report" and then "Document specification".

The different types are the following ones :

- FATCA1 : Initial sending. The file contains only new information.

- FATCA2 : Correction. A report should be corrected in response to an error notification from IRS.

- FATCA3 : Void. A report may be voided at any time after you become aware of inaccurate information. All data element fields in the voided record must have the same values equal to the original record being voided. Do not void a report in response to an error notification.

- FATCA4 : Amend. A report may be amended at any time. An amended report updates an existing report from a previously filed report. All data element fields in the amended report must have the amended values for the relevant account report. Do not amend a report in response to a report error notification, instead file a corrected report with DocTypeIndic FATCA2.

To chose the report to modify, its reference has to be entered in the document reference ID to correct and message reference ID to correct.