Difference between revisions of "UCITS Cross-Border Notifications"

| Line 247: | Line 247: | ||

The status XR or RX will take effect from the selected date.<br> | The status XR or RX will take effect from the selected date.<br> | ||

Update of the notification letter web form to comply with the latest published template from the CSSF.<br> | Update of the notification letter web form to comply with the latest published template from the CSSF.<br> | ||

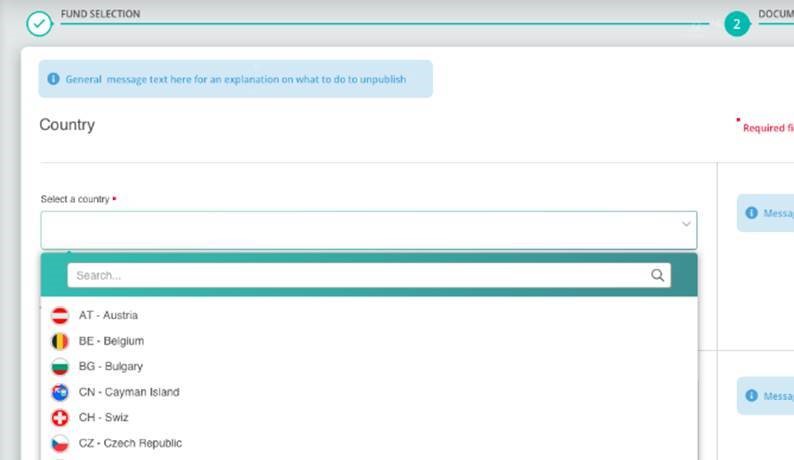

[[File:De-Registration 3.png|| | [[File:De-Registration 3.png||500 px]]<br> | ||

<br><br> | <br><br> | ||

Please note it is not possible to select a date that is less than 15 working days. | Please note it is not possible to select a date that is less than 15 working days. | ||

===Confirm or Cancel=== | ===Confirm or Cancel=== | ||

Revision as of 14:46, 29 March 2024

Introduction

Your module is greyed out? :

To get access to this module, please ask your e-file local administrator to make you member of the Doc OPC et FIS (circ. CSSF) and Doc OPC non luxembourgeois groups.

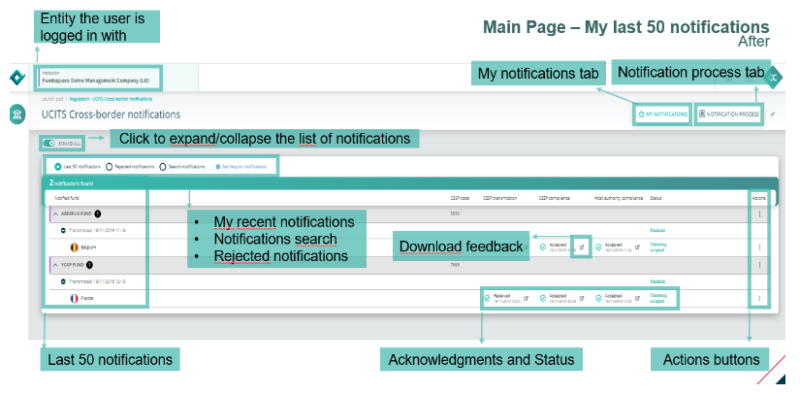

Main Page

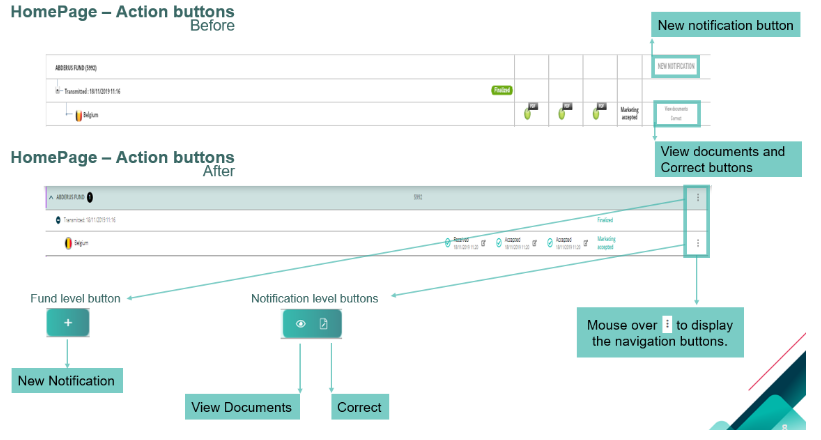

HomePage

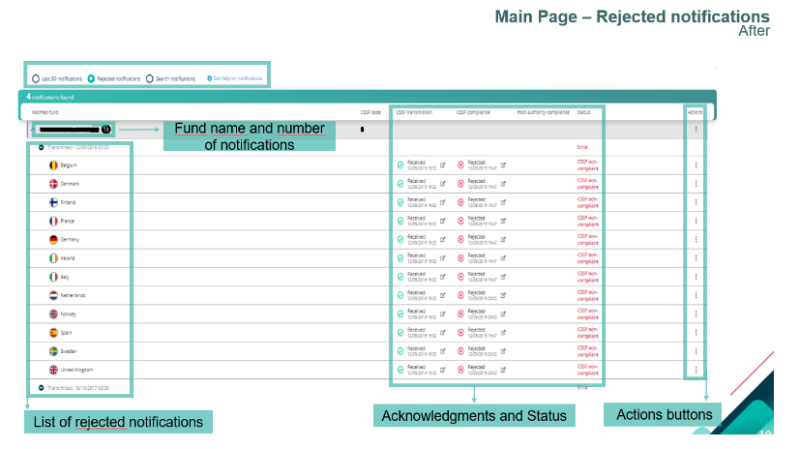

Rejected notifications

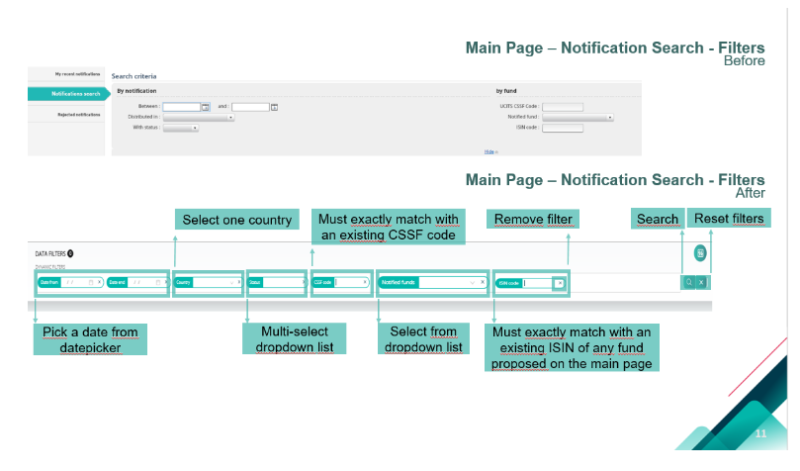

Main Page – Notification Search - Filters

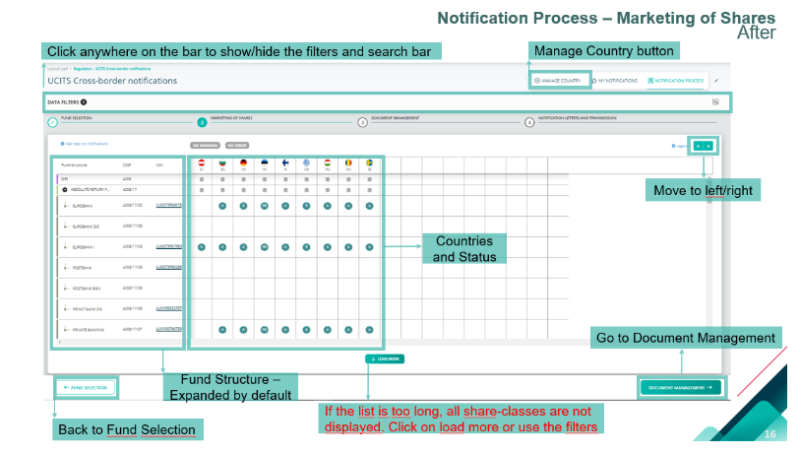

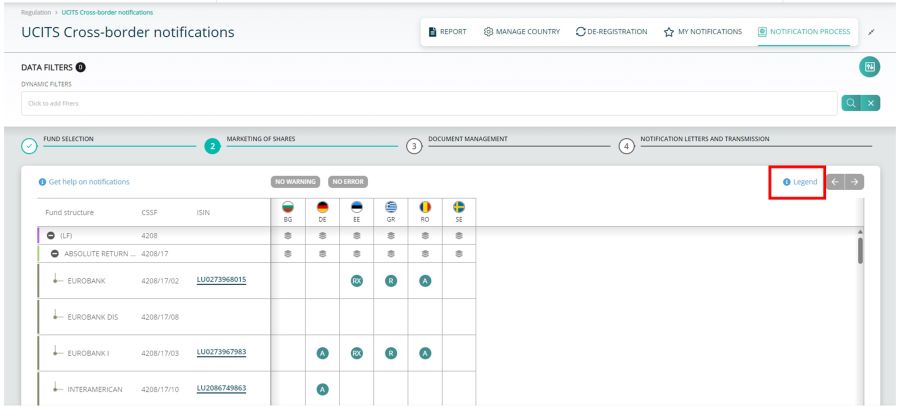

Notification Process

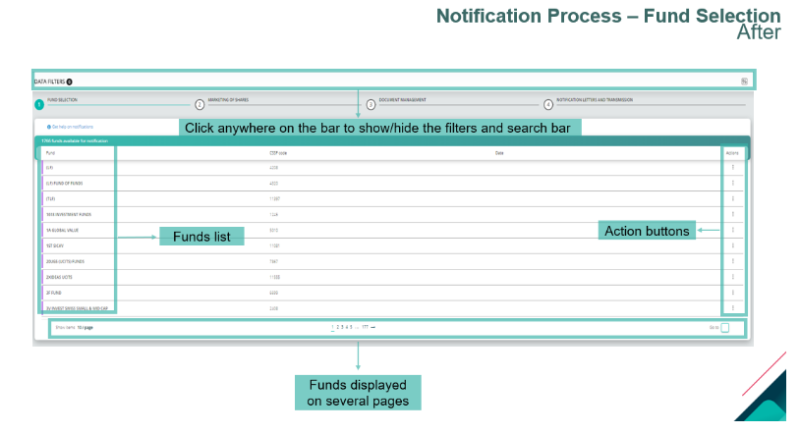

Fund Selection

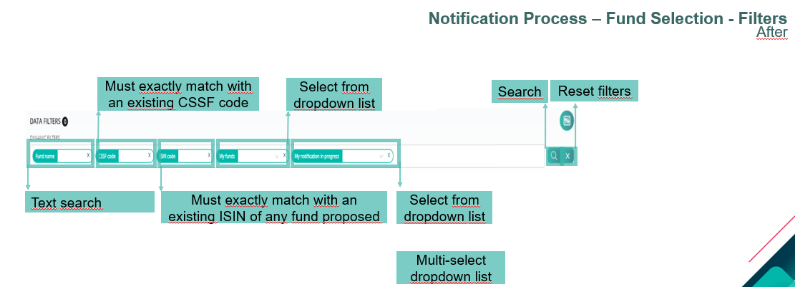

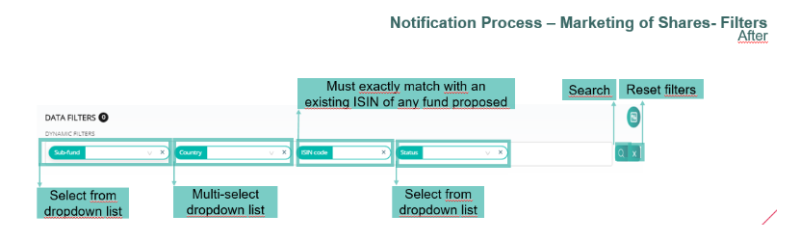

Filters

New - March 2024

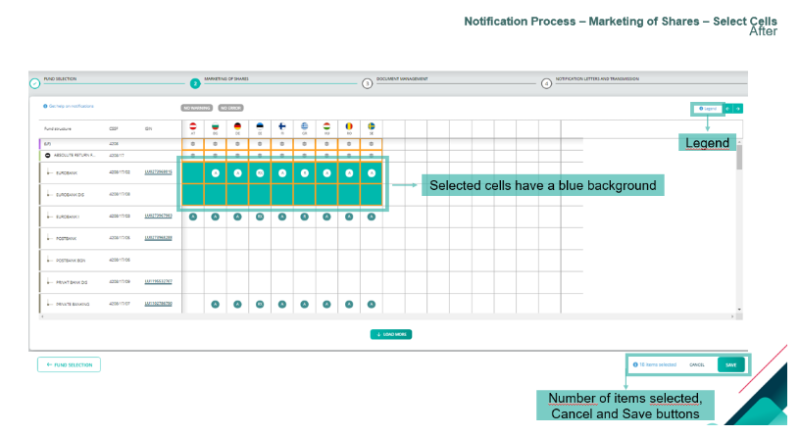

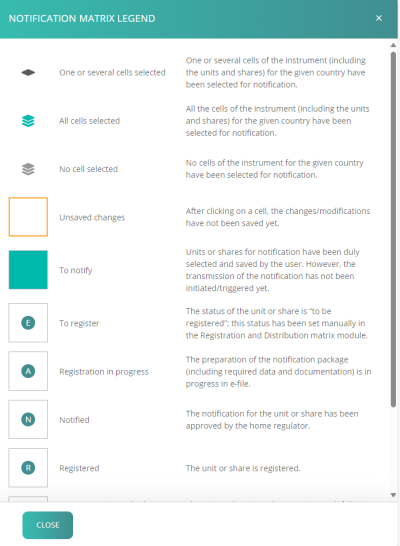

The legend has been updated to provide further detail regarding the functionality and statuses of the registration matrix:

Filters

Select Cells

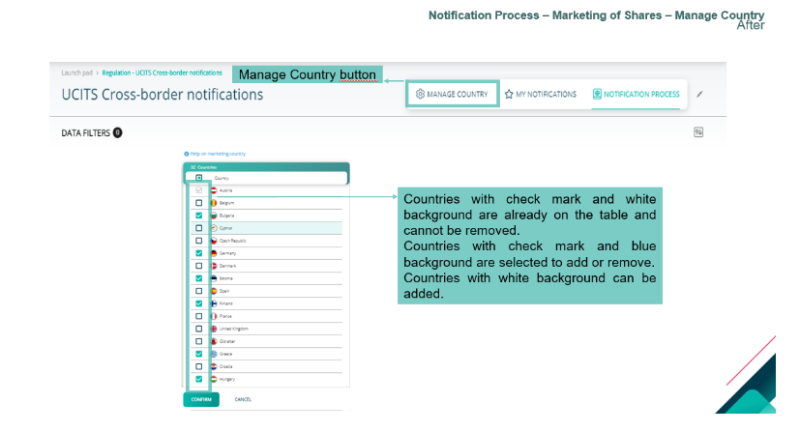

Manage Country

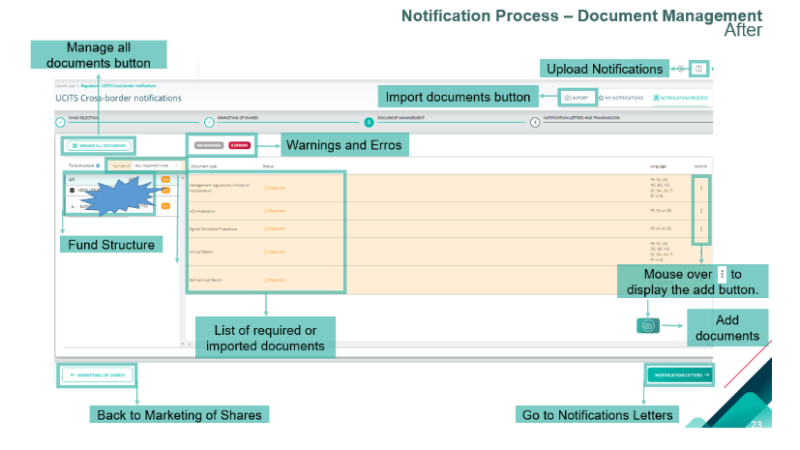

Document Management

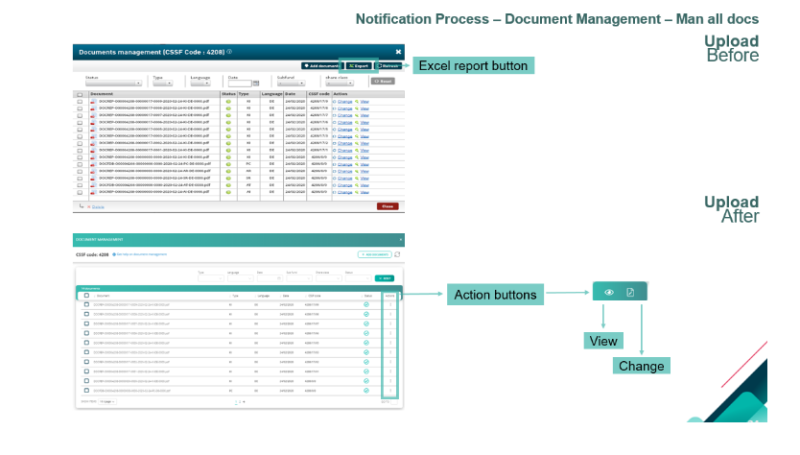

Manage all documents

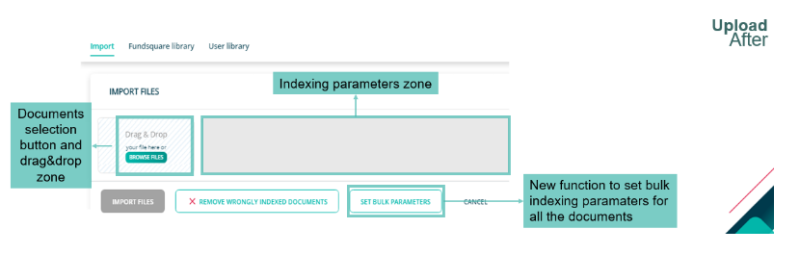

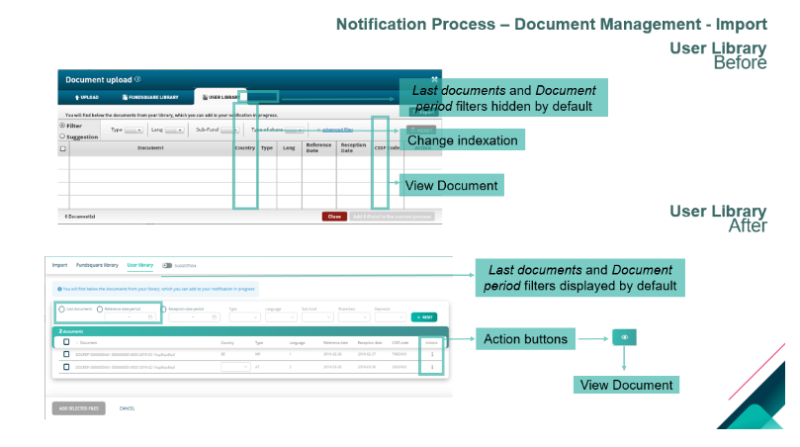

Import

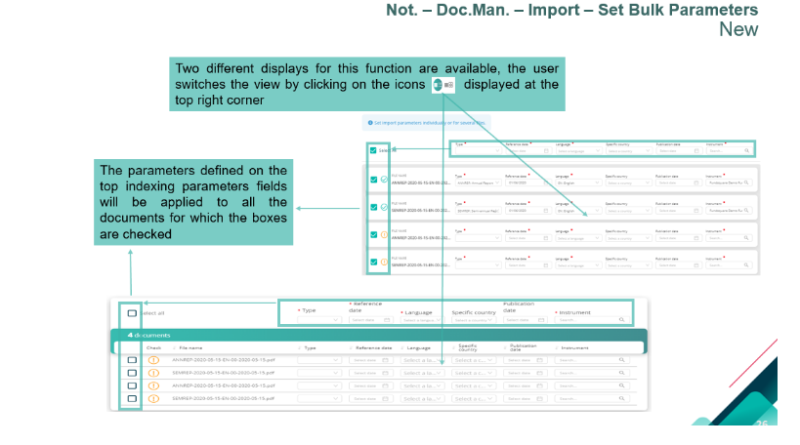

Set Bulk Parameters

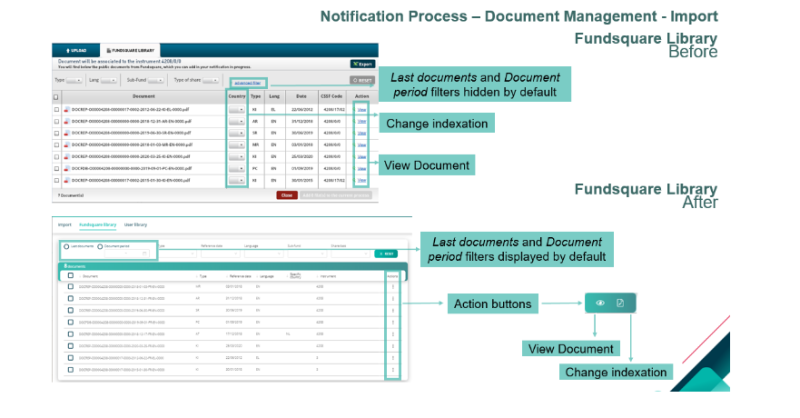

Fundsquare Library

User Library

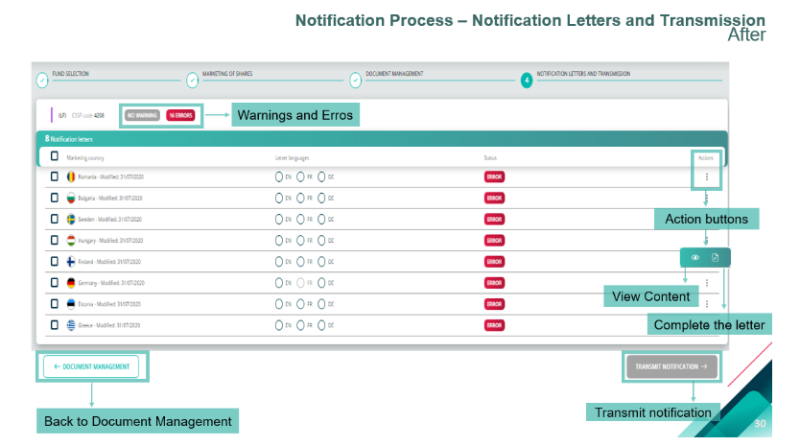

Notification Letters and transmission

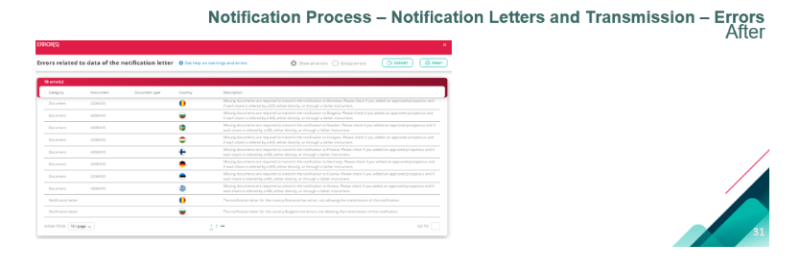

Errors

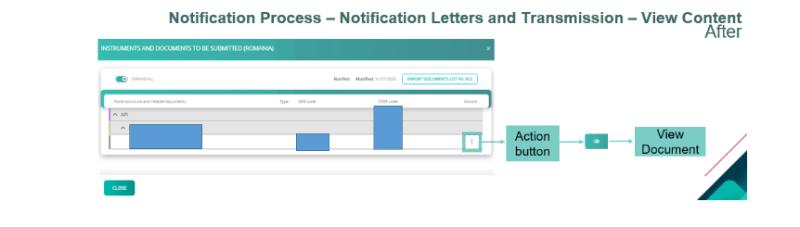

View Content

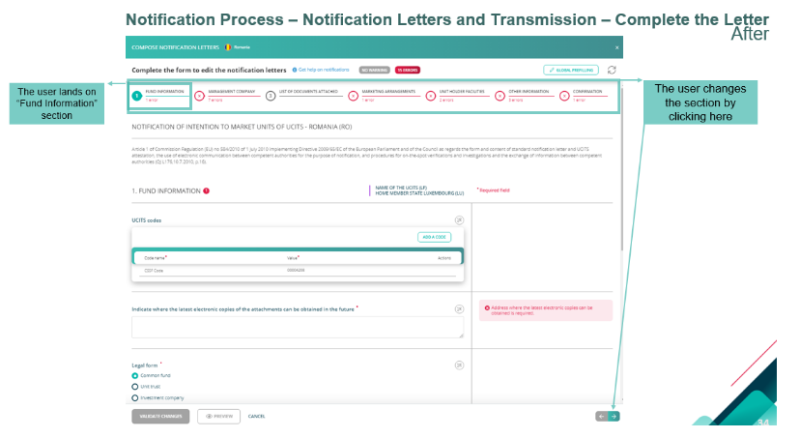

Complete the Letter

New - March 2024

- Update of the notification letter web form to comply with the latest published template from the CSSF.

Additional fields added to the letter:

- LEI code of the UCITS or sub-fund: can be filled via the FSQ suggestion if available.

- LEI code of the Management company: can be filled via the FSQ suggestion if available.

- Contact point for the invoicing or the communication of any application fee or charges: pre-filled with the data from “Details of contact person at the management company”

- Name

- Name of the company

- Position

- Address

- Phone number

- Document attached: Evidence of payment (if required)

- Information on the facilities to perform referred to in Article 93(1) of Directive 2009/65/EC

- Process, subscriptions, repurchase, redemption orders and other payments

- Provision of information on orders, repurchase and redemption proceeds

- Handling of information and access to procedures and arrangements

- Make required information and documents available

- Provision of information relevant to the tasks that the facilities perform in a durable medium

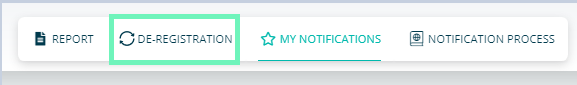

De-registration

The user can start a de-registration by clicking on “De-registration” button.

Fund selection

Upon click on “De-registration” the user must select one of the funds. There is an action: “Deregister”

Documents Settings and Transmission

NEW FUNCTIONALITIES

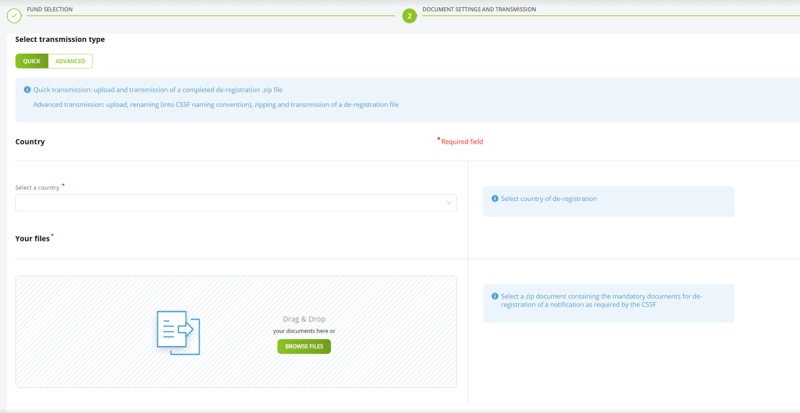

You can now either select a QUICK transmission or an ADVANCED transmission.

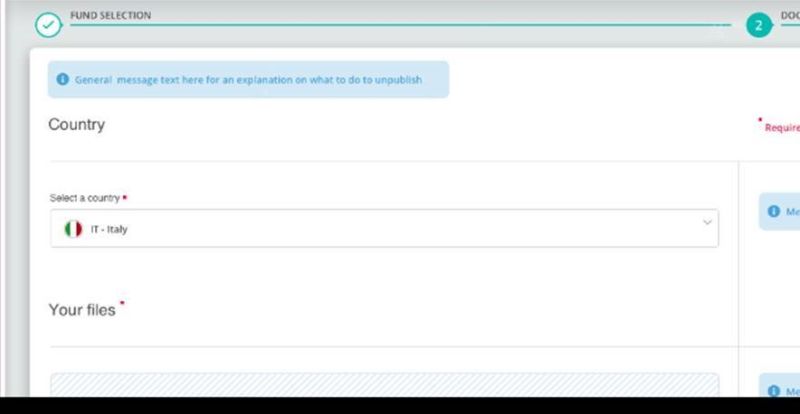

1) For the QUICK transmission, select the country and upload the completed de-registration zip file.

Since 2nd January 2024, your zip file must contain a JSON file. following the CSSF CBD user guide

Should you are not able to produce it on your own, please use the ADVANCED transmission mode

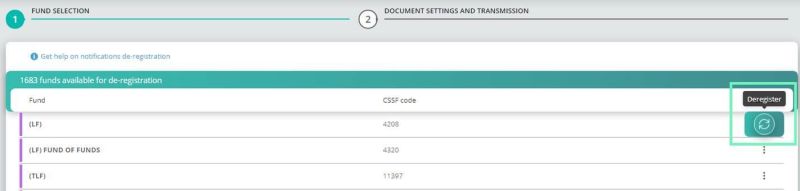

Select a Country

The user must select the wanted country

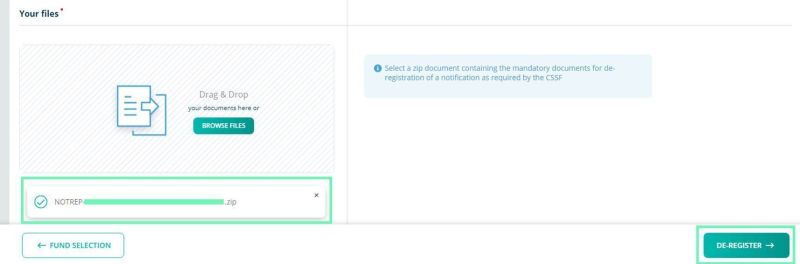

File Selection and De-registration

The user should “Drag&Drop” or “Browse” the zip document and click on “De-Register”.

Note : Please note the CSSF expects to receive a zip containing only denotifcation letter. No sub-folder is accepted.

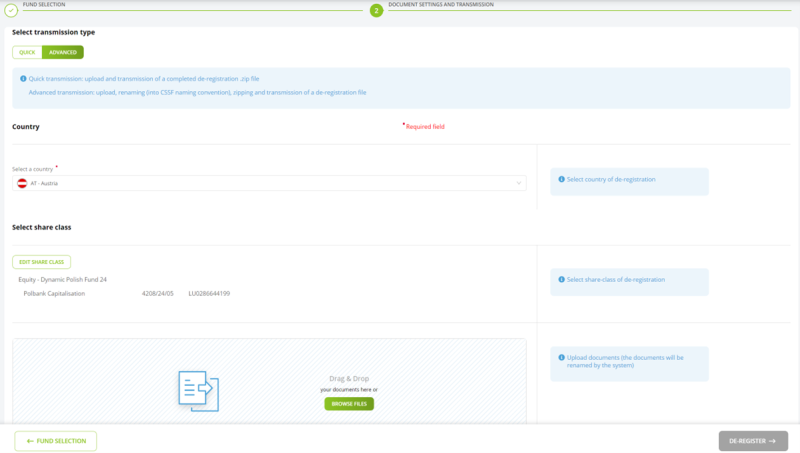

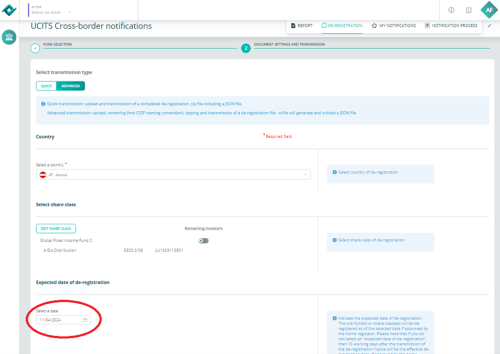

2) For the ADVANCED transmission, select the country, the share-class(es) and upload the documents.

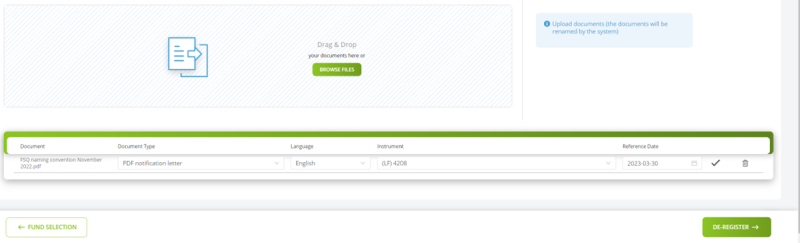

When you upload the documents (PDF not zip archive), you need to select the type, the language, the instrument and the reference date:

New - March 2024

As per the CBDF it is permitted to deregister share classes with remaining investors, if certain requirements are adhered to.

This functionality is now available via the advanced de-registration transmission method.

Upon selecting the share classes you wish to deregister, the user can toggle the below button to indicate if investors remain within the share class:

If you select that no investors remain, then the status of the share class will update to RX once the deregistration is approved.

If you select that investors do remain, then the status of the share class will update to XR once the deregistration is approved.

New - April2024

As required by the CBDF, de-registrations take 15 working days from the point of submission to take effect.

The advanced de-registration transmission method will now automatically select an expected date of de-registration and be pre-populated with the date that is 15 working days from “today”.

Should the user require the de-registration to take effect further than 15 working days from “today” then they can select a date that is further away using the calendar option.

The status XR or RX will take effect from the selected date.

Update of the notification letter web form to comply with the latest published template from the CSSF.

Please note it is not possible to select a date that is less than 15 working days.

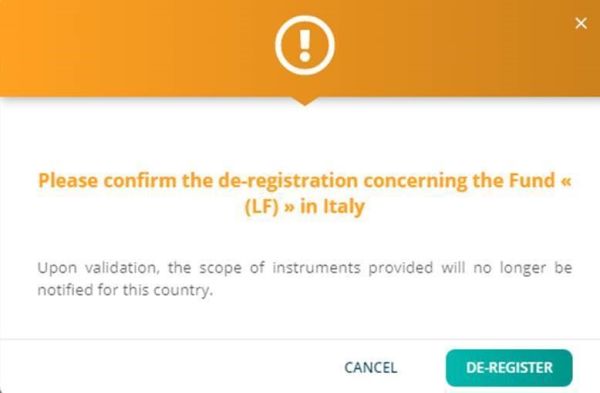

Confirm or Cancel

The user can confirm or cancel the de-registration

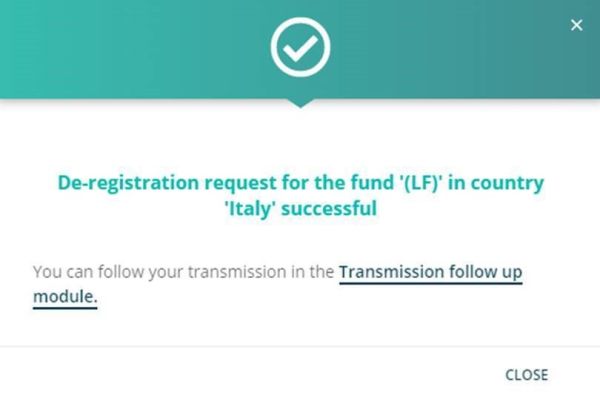

Confirmation pop-up

By clicking on “Transmission follow up module” the user is redirect to this module.

Feedback

Any feedback from the CSSF will be found in the Transmission follow-up. These are in 3 files:

1. NOTFBR

2. NOTFDB

3. NOTFBH