Difference between revisions of "FATCA Manual"

| (32 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

<small>''Page's last update : 26 September 2023''</small> | |||

__TOC__ | |||

=Introduction= | |||

The Luxembourg Tax Authority ('''Administration des contributions directes''' ([http://www.impotsdirects.public.lu/fr/echanges_electroniques.html ACD])) published on 19 January 2017 an updated version of the circular [http://www.impotsdirects.public.lu/content/dam/acd/fr/legislation/legi17/echa3-sans-tc-2017-01-19.pdf ECHA3] defining the new format that takes into account the Internal Revenue Services (IRS) FATCA XSD 2.0. Luxembourg Financial Institutions will have to use this new schema, as it will be the only one accepted as from now. | |||

'''IMPORTANT''': all '''pre-filled''' data have to be communicated to Fundsquare in order to be integrated in Fundsquare's database and to be available in the FATCA form | |||

Consult our [https://www.e-file.lu/wiki/index.php/FATCA_Onboarding FATCA Onboarding] for more detailed information. | |||

=Report type= | =Report type= | ||

[[ | Choose the 'FATCA Form' in the [[ReportGeneration|Report Generation]] module. | ||

The '''FATCA form''' opens and a small window pops up where you have to select the '''FATCA report type'''. | |||

In our example we will select FATCA report. | In our example we will select FATCA report. | ||

| Line 81: | Line 26: | ||

=FATCA form= | |||

[[File:2 AfterFormFatca.png|600 px]] | [[File:2 AfterFormFatca.png|600 px]] | ||

==Contact information== | |||

This is the Luxembourgish part of the FATCA report. | |||

This is the Luxembourgish part of the FATCA report | |||

[[File:2AfterFatcaContact.png|400px]] | [[File:2AfterFatcaContact.png|400px]] | ||

The '''contact''' '''information''' is split into 2 sections: | |||

1. '''Information on depositor''' | 1. '''Information on depositor''' | ||

2. '''Reporting | 2. '''AEOI Reporting FI''' | ||

These sections can be accessed via the buttons in the vertical navigation bar or directly clicking the sections' titles. | |||

==AEOI reference== | ==AEOI reference== | ||

[[File:2AfterFatcaAEOIRef.png|400px]] | [[File:2AfterFatcaAEOIRef.png|400px]] | ||

*This field has to be completed by a Globally Unique Identifier (GUID) that can be | *This field has to be completed by a Globally Unique Identifier (GUID) that can be chosen freely in accordance with certain rules described in [http://www.impotsdirects.public.lu/content/dam/acd/fr/legislation/legi17/echa3-sans-tc-2017-01-19.pdf ECHA - n° 3 of 19 January 2017, page 13]. | ||

* | *Specifications: only capital characters (A-Z), number 0-9, must be unique, etc. | ||

*The ACD recommends not to use personal data such as the name or account number, but rather a sequential number. | *The ACD recommends not to use personal data such as the name or account number, but rather a sequential number. | ||

| Line 159: | Line 67: | ||

==Information on depositor== | ==Information on depositor== | ||

[[File:DepositorNamePIN.png|border|400px]] | [[File:DepositorNamePIN.png|border|400px]] | ||

| Line 173: | Line 75: | ||

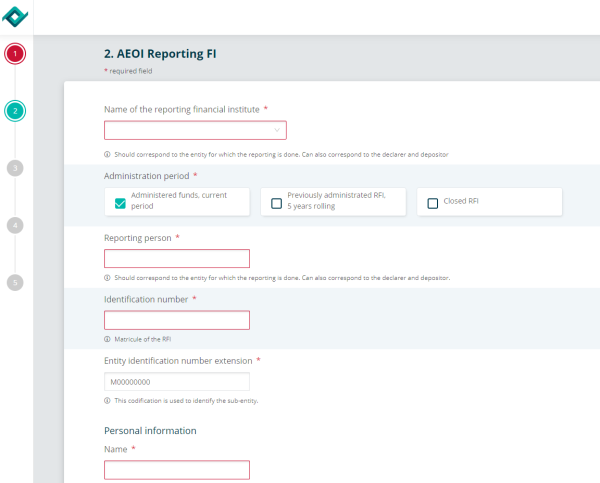

==AEOI Reporting FI== | |||

== | |||

[[File:ReportingPersonExtensionSubEntity.png|border|600px]] | [[File:ReportingPersonExtensionSubEntity.png|border|600px]] | ||

The information on '''Reporting person''' has to be completed in '''section 2''' of the form. | |||

*'''Name of the reporting financial institution''': Select the entity in the drop-down list for which the reporting is done. | *'''Name of the reporting financial institution''': Select the entity in the drop-down list for which the reporting is done. | ||

| Line 206: | Line 85: | ||

*'''Identification number''' (pre-filled with the Luxembourgish '''Matricule''' Number once the RFI has been selected) | *'''Identification number''' (pre-filled with the Luxembourgish '''Matricule''' Number once the RFI has been selected) | ||

*'''Entity Identification number extension''' (pre-filled with the value "M00000000"): "M00000000" is the default value if you have no extention code to communicate. | *'''Entity Identification number extension''' (pre-filled with the value "M00000000"): "M00000000" is the default value if you have no extention code to communicate. | ||

*'''Personnal information''' The ACD needs contact details of a person who would be able to answer business questions regarding the report. | |||

| Line 211: | Line 91: | ||

If the RFI has no Luxembourgish '''Matricule''' Number the instructions published on the ACD website have to be followed (Cf.: [http://www.impotsdirects.public.lu/fr/profil/organigramme/direction/division_echange_renseignements_retenue_interets.html Contact_Division échange de renseignements et retenue d’impôt sur les intérêts]). | If the RFI has no Luxembourgish '''Matricule''' Number the instructions published on the ACD website have to be followed (Cf.: [http://www.impotsdirects.public.lu/fr/profil/organigramme/direction/division_echange_renseignements_retenue_interets.html Contact_Division échange de renseignements et retenue d’impôt sur les intérêts]). | ||

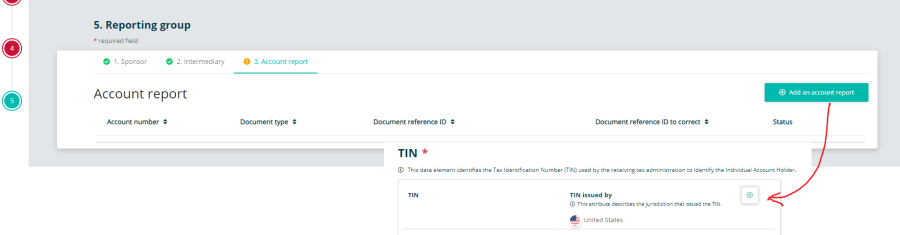

==Reporting group - Account report - TIN== | ==Reporting group - Account report - TIN== | ||

| Line 270: | Line 118: | ||

== Export - import files - save work in progress == | == Export - import files - save work in progress == | ||

[[File:CRS-After-SaveLocallyButton.png|border|500px]] | |||

[[File: | |||

'''<u>Report type</u>''' button | '''<u>Report type</u>''' button | ||

| Line 315: | Line 146: | ||

If all buttons of the sidebar are green, the '''Transmission button''' will become available and the report can be transmitted to the regulator. | If all buttons of the sidebar are green, the '''Transmission button''' will become available and the report can be transmitted to the regulator. | ||

== File transmission == | == File transmission == | ||

When the form is completed and all ticks are green, you can click the [[File:After-CRS-TransmitButtton.png|border|80px]] button. | |||

A drawer opens from the right, fill the form and click 'Transmit'. | |||

[[File:CRS Transmit.png|border|500px]] | |||

'''Note''': the file name is automatically generated and compliant to the ACD file naming convention. | |||

== Transmission follow up == | |||

Please consult our wiki page [[Transmission_Monitoring|'''Transmission Monitoring''']] | |||

= Automatic filing through the Sending Service = | = Automatic filing through the Sending Service = | ||

*Should you need further information on the Sending Service, please see our [[Sending_Service_home|sending service's wiki page.]] | |||

*Should you need further information on the Sending Service, please | |||

[ | |||

[ | |||

| Line 490: | Line 223: | ||

| B = Bourse | | B = Bourse | ||

|- | |- | ||

| | | MatriculeDepositor | ||

| Social Security Identification Number | | Social Security Identification Number | ||

| Number(11) - Number(13) | | Number(11) - Number(13) | ||

| Line 542: | Line 275: | ||

Cf. [http://www.impotsdirects.public.lu/content/dam/acd/fr/legislation/legi17/echa3-sans-tc-2017-01-19.pdf ECHA - n° 3 of 19 January 2017; page 19-20] | Cf. [http://www.impotsdirects.public.lu/content/dam/acd/fr/legislation/legi17/echa3-sans-tc-2017-01-19.pdf ECHA - n° 3 of 19 January 2017; page 19-20] | ||

== Report transmission == | == Report transmission == | ||

| Line 552: | Line 281: | ||

Ensure that the '''FATCA file naming convention''' is applied (Cf. [[#FATCA file naming convention|FATCA file naming convention]]). | Ensure that the '''FATCA file naming convention''' is applied (Cf. [[#FATCA file naming convention|FATCA file naming convention]]). | ||

== File processing status generated by the Sending Service == | == File processing status generated by the Sending Service == | ||

See [[Sending_Service#Transmission_following | our wiki upon the sending service ]] to understand the sending service's follow up. | |||

== File transmission status == | |||

== File transmission | |||

ACD's feedback files are available in the sub-folder "Replies": '''.../ServiceDeposant/ReportingDiffusion/FATCA/Replies/'''. | ACD's feedback files are available in the sub-folder "Replies": '''.../ServiceDeposant/ReportingDiffusion/FATCA/Replies/'''. | ||

| Line 596: | Line 299: | ||

The "Replies" folder is created upon feedback receipt. Please check the Sending Service's configuration if the "Replies" folder is not available. In the configuration file (properties file), the variable corresponding to "Configuration of connection for feedback" and the one corresponding to "Configuration of connection for authority acknowledgement" should be set to "up". | The "Replies" folder is created upon feedback receipt. Please check the Sending Service's configuration if the "Replies" folder is not available. In the configuration file (properties file), the variable corresponding to "Configuration of connection for feedback" and the one corresponding to "Configuration of connection for authority acknowledgement" should be set to "up". | ||

=How to correct, void or amend validated reports= | =How to correct, void or amend validated reports= | ||

| Line 607: | Line 306: | ||

The different types are the following ones : | The different types are the following ones : | ||

*'''FATCA1''' : | *'''FATCA1''' : <span style="color:darkcyan">Initial sending</span>. The file contains only new information. | ||

*'''FATCA2''' : | *'''FATCA2''' : <span style="color:darkcyan">Correction</span>. A report should be corrected in response to an error notification from IRS. | ||

*'''FATCA3''' : | *'''FATCA3''' : <span style="color:darkcyan">Void</span>. A report may be voided at any time after you become aware of inaccurate information. All data element fields in the voided record must have the same values equal to the original record being voided. Do not void a report in response to an error notification. | ||

*'''FATCA4''' : | *'''FATCA4''' : <span style="color:darkcyan">Amend</span>. A report may be amended at any time. An amended report updates an existing report from a previously filed report. All data element fields in the amended report must have the amended values for the relevant account report. Do not amend a report in response to a report error notification, instead file a corrected report with DocTypeIndic FATCA2. | ||

To chose the report to modify, its reference has to be entered in the '''document reference ID to correct''' and '''message reference ID to correct'''.<br/> | To chose the report to modify, its reference has to be entered in the '''document reference ID to correct''' and '''message reference ID to correct'''.<br/> | ||

Latest revision as of 13:12, 26 September 2024

Page's last update : 26 September 2023

Introduction

The Luxembourg Tax Authority (Administration des contributions directes (ACD)) published on 19 January 2017 an updated version of the circular ECHA3 defining the new format that takes into account the Internal Revenue Services (IRS) FATCA XSD 2.0. Luxembourg Financial Institutions will have to use this new schema, as it will be the only one accepted as from now.

IMPORTANT: all pre-filled data have to be communicated to Fundsquare in order to be integrated in Fundsquare's database and to be available in the FATCA form Consult our FATCA Onboarding for more detailed information.

Report type

Choose the 'FATCA Form' in the Report Generation module.

The FATCA form opens and a small window pops up where you have to select the FATCA report type.

In our example we will select FATCA report.

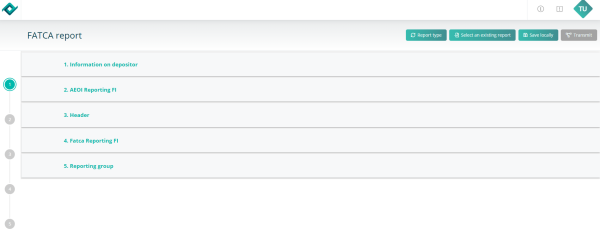

FATCA form

Contact information

This is the Luxembourgish part of the FATCA report.

The contact information is split into 2 sections:

1. Information on depositor

2. AEOI Reporting FI

These sections can be accessed via the buttons in the vertical navigation bar or directly clicking the sections' titles.

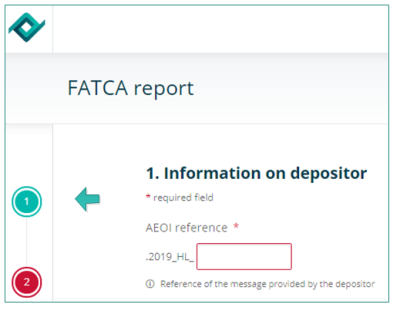

AEOI reference

- This field has to be completed by a Globally Unique Identifier (GUID) that can be chosen freely in accordance with certain rules described in ECHA - n° 3 of 19 January 2017, page 13.

- Specifications: only capital characters (A-Z), number 0-9, must be unique, etc.

- The ACD recommends not to use personal data such as the name or account number, but rather a sequential number.

Cf. ECHA - n° 3 of 19 January 2017, page 13.

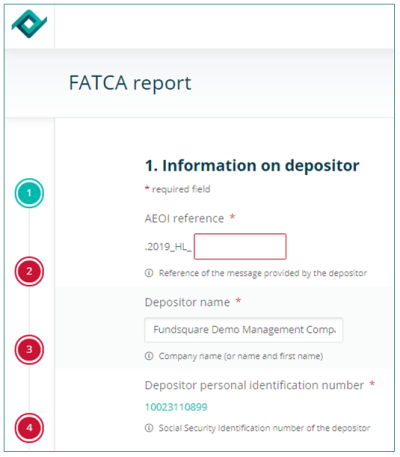

Information on depositor

- Depositor name (pre-filled): The Depositor is an entity (legal or natural person) that is in charge of filing the FATCA reporting to the ACD (e.g. Service provider). Cf. ECHA - n° 3 of 19 January 2017, page 6.

- Personal Identification Number (pre-filled): The Depositor needs a Personal Identification Number (Luxembourgish Matricule Number also known as CCSS code) to be able to file the report.

AEOI Reporting FI

The information on Reporting person has to be completed in section 2 of the form.

- Name of the reporting financial institution: Select the entity in the drop-down list for which the reporting is done.

- Reporting person (pre-filled once the RFI has been selected)

- Identification number (pre-filled with the Luxembourgish Matricule Number once the RFI has been selected)

- Entity Identification number extension (pre-filled with the value "M00000000"): "M00000000" is the default value if you have no extention code to communicate.

- Personnal information The ACD needs contact details of a person who would be able to answer business questions regarding the report.

IMPORTANT: If a sub-entity has to file a FATCA reporting and does not have a Luxembourgish Matricule Number, it must enter the parent Luxembourgish Matricule Number in the first field and an additional identifier in the second field. For example, sub-funds have to enter the Luxembourgish Matricule Number of the umbrella fund in the Identification Number field and enter the sub-fund number in the Entity Identification number extension field. Cf. details ECHA - n° 3 of 19 January 2017, page 9.

If the RFI has no Luxembourgish Matricule Number the instructions published on the ACD website have to be followed (Cf.: Contact_Division échange de renseignements et retenue d’impôt sur les intérêts).

Reporting group - Account report - TIN

VERY IMPORTANT INFORMATION

If no TIN is available the value #NTA001# has to be entered in the TIN field.

Zero Reporting

The ACD requires one reporting each year from each Luxembourg Reporting Financial Institution registered with the IRS.

Luxembourg Reporting Financial Institutions that have no Reportable Accounts to report for a year, must inform the ACD by sending a Zero Reporting to the ACD.

Cf. ECHA - n° 3 of 19 January 2017, page 21.

Export - import files - save work in progress

Report type button

Press the REPORT TYPE button, if you want to change your FATCA Report Type. A small window pops up where you can select the report type you need:

- - Contact update

- - Zero report

- - FATCA report

Select an existing report button

This button allows you to upload an existing XML report from your network or hard-drive into the report generator.

Save locally button

Work in progress on a report has to be saved with this button. Work in progress means that the report is not finalized, as important data are missing. The exported .xml file will be called DRAFT_filename.xml and cannot be uploaded for filing. It can be imported onto the tool for later use.

If you save locally a final report, meaning that all relevant data are available inside the report, it will carry the correct naming convention for submission to the Regulator.

Transmit button

If all buttons of the sidebar are green, the Transmission button will become available and the report can be transmitted to the regulator.

File transmission

When the form is completed and all ticks are green, you can click the ![]() button.

button.

A drawer opens from the right, fill the form and click 'Transmit'.

Note: the file name is automatically generated and compliant to the ACD file naming convention.

Transmission follow up

Please consult our wiki page Transmission Monitoring

Automatic filing through the Sending Service

- Should you need further information on the Sending Service, please see our sending service's wiki page.

FATCA file naming convention

The following naming convention has to be applied for the files:

XML file :

FATCA_${DateTime}_${Type}_${FiscalYear}_${Channel}_${MatriculeDepositor}_${GIIN}_${ProdTest}.xml

Feedback from ACD :

FATCA_${DateTime}_${Type}_${FiscalYear}_${Channel}_${MatriculeDepositor}_${GIIN}_${ProdTest}_${Status}.xml

| Code | Definition | Structure | Values |

|---|---|---|---|

| DateTime | Creation date and time of the XML file | Number(14) | YYYYMMDDhhmmss |

| Type | F0: ZeroReport or new contact data without FATCA data

F1: FATCA1–New data F2: FATCA2–Correction–Data corrected upon request of the IRS F3: FATCA3–Void–Cancellation of data F4: FATCA4–Amendment–Data corrected at any time |

Char(1)Number(1) | F0

F1 F2 F3 F4 |

| FiscalYear | Fiscal year | Number(4) | YYYY |

| Channel | Communication channel | Char(1) | B = Bourse |

| MatriculeDepositor | Social Security Identification Number | Number(11) - Number(13) | Code CCSS |

| GIIN | GIIN (Global Intermediary Identification Number ) of the declarer | Char(6).Char(5).Char(2).Number(3) | Code GIIN XXXXXX.XXXXX.XX.XXX |

| ProdTest | Environment type | Char(1) | P = Production

T = Test |

| Status | Response status | Char(3) | Technical Feedback

ACK = File received by ACD NAK = File rejected by ACD Business Feedback VAL = Validated and imported by ACD WAR = Validated and imported by ACD but with small issues that raised a warning ERR = File rejected |

Examples:

XML file:

FATCA_20150520080022_F0_2016_B_1970010112345_006M8M.00000.LE.442_P.xml

FATCA_20150520080023_F1_2016_B_19700202123_ZZLRV4.99999.SL.442_T.xml

Feedback from ACD :

FATCA_20150520080022_F0_2016_B_1970010112345_006M8M.00000.LE.442_P_ack.xml

FATCA_20150520080023_F1_2016_B_19700202123_ZZLRV4.99999.SL.442_T_ack.xml

Cf. ECHA - n° 3 of 19 January 2017; page 19-20

Report transmission

In order to send a report with the Sending Service, the exported .xml report has to be copied into the …/ServiceDeposant/ReportingDiffusion/FATCA subfolder.

Ensure that the FATCA file naming convention is applied (Cf. FATCA file naming convention).

File processing status generated by the Sending Service

See our wiki upon the sending service to understand the sending service's follow up.

File transmission status

ACD's feedback files are available in the sub-folder "Replies": .../ServiceDeposant/ReportingDiffusion/FATCA/Replies/.

Each feedback has a specific status which is available in the file name: ACK, NAK, VAL, WAR, ERR (Cf. Status feedback ACD).

Feedback from ACD :

FATCA_20150520080022_F0_2016_B_1970010112345_006M8M.00000.LE.442_P_ack.xml

FATCA_20150520080023_F1_2016_B_19700202123_ZZLRV4.99999.SL.442_T_ack.xml

The "Replies" folder is created upon feedback receipt. Please check the Sending Service's configuration if the "Replies" folder is not available. In the configuration file (properties file), the variable corresponding to "Configuration of connection for feedback" and the one corresponding to "Configuration of connection for authority acknowledgement" should be set to "up".

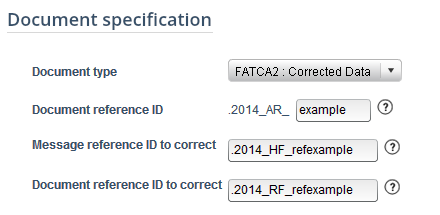

How to correct, void or amend validated reports

In order to correct, void or amend reports through the FATCA Form (Report Generator), the type of modification (FATCA2, FATCA3, FATCA4) has to be selected in the "Reporting FI" tab, section "Document Specification" and in the "Reporting Group" tab, section "Account Report" and then "Document specification".

The different types are the following ones :

- FATCA1 : Initial sending. The file contains only new information.

- FATCA2 : Correction. A report should be corrected in response to an error notification from IRS.

- FATCA3 : Void. A report may be voided at any time after you become aware of inaccurate information. All data element fields in the voided record must have the same values equal to the original record being voided. Do not void a report in response to an error notification.

- FATCA4 : Amend. A report may be amended at any time. An amended report updates an existing report from a previously filed report. All data element fields in the amended report must have the amended values for the relevant account report. Do not amend a report in response to a report error notification, instead file a corrected report with DocTypeIndic FATCA2.

To chose the report to modify, its reference has to be entered in the document reference ID to correct and message reference ID to correct.